Stablecoins & U.S. Banks: Why 2025 Is a Turning Point

A strategic guide for bank leaders, fintech teams, and crypto curious operators on where stablecoins fit into modern banking and why waiting is the riskiest move.

Disclaimer: This piece is part of essays where I explore the intersection of fintech, policy, and infrastructure. All views are my own.

TLDR

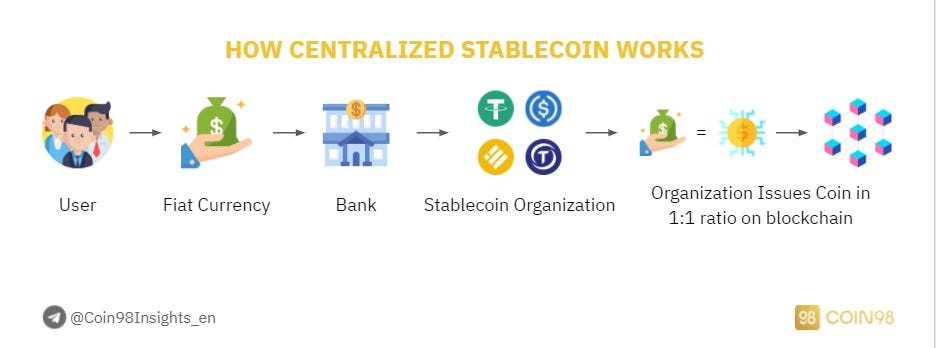

Traditional banks in the U.S. are staring down a moment they can’t ignore. Stablecoins, digital currencies pegged to the U.S. dollar have moved beyond crypto trading and into real-world payments. These blockchain based “digital dollars” settle instantly, work 24/7, and cost next to nothing to move. That’s hard to ignore in a world where wires still take days and come with a $30 fee.

Some banks are already starting to look for solutions instead of treating stablecoins as threats. They see them as extensions of services they already provide: store value and move money. And stablecoins do both at scale, across borders, and without downtime.

So the question isn’t if banks should get involved. It’s how and whether they can move fast enough to do so.

Before we go deeper, here’s how this essay is structured. First, we’ll look at how stablecoins improve the customer experience (remittances, accessibility, etc). Then we’ll shift to the bank’s perspective: what they stand to gain, and how they can make it work. Lastly, we’ll tackle the hard parts: privacy, regulation, and infrastructure along with a look at the economics.

Customer Use Cases for Bank Backed Stablecoins

To begin let’s take a look at how integrating stablecoins into bank wallets can unlock a range of positive use cases for customers, enhancing convenience and access in ways current traditional banking tech cannot easily match.

Fast, Low-Cost Remittances

Customers can send money overseas to family or business partners in minutes using stablecoins, bypassing the slow SWIFT correspondent network. Stablecoin transfers often cost a fraction of traditional remittance fees. For example, sending $200 from the U.S. to Colombia costs about $12 using legacy methods, but as little as $0.01 with stablecoins in an optimal setup. On average, stablecoin remittance fees range around 0.5–3.0%, far lower than the ~6% global average for traditional remittances. This means more money makes it to recipients, and at a faster rate. An easy win for customers who regularly send cross-border payments.

SWIFT is the traditional messaging system banks use for cross-border payments. It's slow and expensive because it involves many intermediaries.

24/7 Instant Payments

With stablecoins, a customer can transfer funds any time, any day, with instant settlement. There’s no waiting for “banking hours” or ACH batch windows. This immediacy is especially useful for time sensitive transactions or when banking networks are offline during weekends and holidays.

ACH is the U.S. system for moving funds between banks, but it processes in batches and shuts down on weekends.

Stable Value for Digital Asset Trading

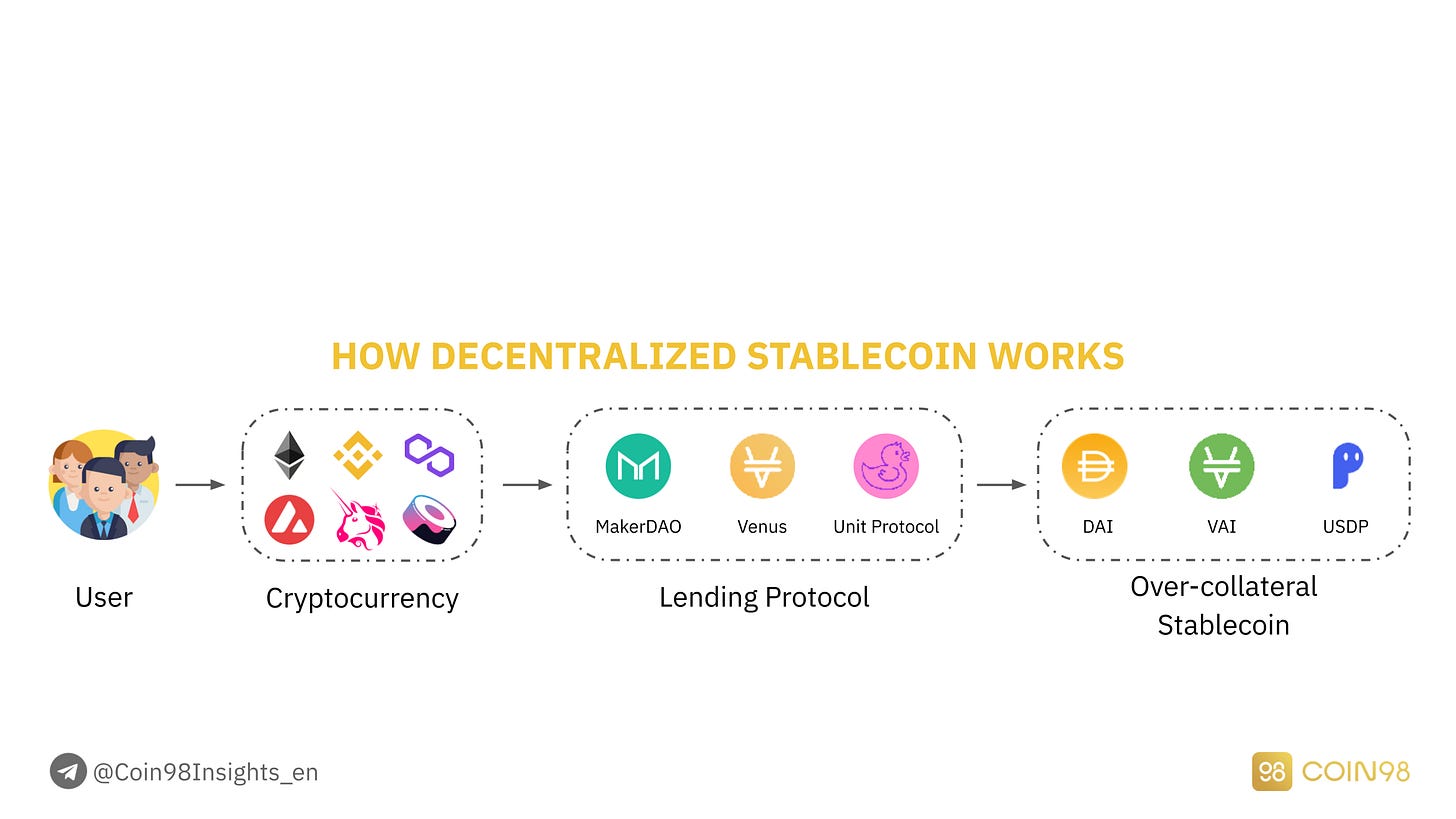

Customers interested in cryptocurrency could hold stablecoins (like USDC or USDT) directly in their bank provided wallet. This gives them a stable digital asset to easily move into crypto markets or DeFi applications, without leaving the bank’s ecosystem. For example, a user could convert part of their checking balance into a stablecoin to buy crypto on an exchange, or to interact with blockchain-based services, and convert back when finished, all through their bank’s interface.

USDC and USDT are stablecoins pegged to the U.S. dollar, used widely in crypto markets backed by Circle (USDC) and Tether (USDT).

E-Commerce and Micropayments

As more merchants (especially online) begin accepting stablecoins, customers could pay directly from their bank-issued stablecoin wallet. This can reduce payment friction for international e-commerce. A U.S. customer could pay a European merchant in dollar stablecoins, and the merchant can accept it without worrying about FX conversion delays. Moreover, stablecoins enable micropayments due to low fees, so customers might use them for pay-per-use digital content or small IoT transactions.

Multi-currency and International Portability

A U.S. dollar stablecoin is effectively a global dollar. Customers traveling or living abroad could keep funds in USD stablecoins in their bank app, then spend or convert locally as needed, potentially avoiding poor local exchange rates or the need for cash. In markets with volatile local currencies, a stablecoin account from a U.S. bank offers an accessible store of value. While regulatory and banking rules would govern availability in different countries, the demand for dollar stability is high worldwide, and a regulated U.S. bank could safely extend stablecoin services to meet that need (with proper compliance for foreign users).

These use cases all center on one thing: an improved customer experience. Consumers today demand faster, cheaper, and more transparent payments. More importantly, the technology itself can be abstracted away. A customer may not even know they’re transacting on blockchain.

As Raj Dhamodharan of Mastercard puts it, users care that “payments just work,” not whether they run on stablecoins or traditional rails.

Strategic Benefits for Banks

Why should banks bother with stablecoins? Simply put, they help future proof banks’ roles in the financial ecosystem and unlock new revenue streams. Below we analyze some of these potential benefits.

Staying Relevant Amid Fintech Disruption

Fintechs and even non-banks are embracing stablecoins, which could siphon off customers. For example, PayPal launched its own USD stablecoin (PYUSD) and is rolling it out across platforms. If users begin holding funds in fintech-issued stablecoins, that's value leaving the banking system. Banks offering similar services can keep customers within their ecosystem and prevent disintermediation.

New Products and Revenue Streams

Stablecoins open the door to products that didn’t previously exist. Banks could issue their own branded stablecoins (fully backed by deposits) for instant peer-to-peer payments or internal transfers. With enabling legislation, banks will be allowed to issue stablecoins and create new financial products on top of them. A branded stablecoin builds trust and recognition, acting as a digital extension of the bank’s balance sheet. JPMorgan has already moved in this direction with JPM Coin.

This strategy also brings revenue. Banks can earn interest on reserve assets backing the stablecoin, as well as fees for usage. Even if banks do not issue stablecoins, they can serve as custodians, provide treasury services, or process payments for third-party issuers. Each of these functions offers opportunities to charge for account maintenance or operational infrastructure.

Faster Settlement and Operational Efficiency

Internally, stablecoins can streamline bank operations. Consider cross-border interbranch transfers or corporate payments. Today, banks juggle nostro/vostro accounts and liquidity across time zones. A stablecoin used inside a bank’s network could consolidate liquidity and enable near-instant settlement between subsidiaries. This reduces friction and speeds up transaction settlement.

Banks can also cut down clearing times for customer payments. Stablecoins can serve as shared ledgers, reducing the need for intermediaries and reconciliation. The result is a leaner, more responsive institution.

Global Reach and New Markets

Stablecoins can extend services to new customer segments and geographies. As internet-native money, they allow U.S. banks to attract international clients seeking dollar stability and regulated institutions. For instance, a small business in Asia might use a U.S. bank’s stablecoin account for trade settlements, or a fintech in Latin America could store value in USDC.

Stablecoins also position banks to tap into the growing digital economy. From online marketplaces to DeFi protocols, banks that provide trusted access may become gateways to this ecosystem. In the $800 billion remittance market, stablecoin based services can also give banks a foothold where money transfer operators previously dominated.

Many analysts view this as a time-sensitive opportunity. Citi, for instance, projects that the stablecoin market could grow fivefold within five years, potentially reaching trillions in circulation. Banks that enter early will benefit from brand recognition, customer familiarity, and operational expertise that are difficult for others to replicate. In other words, stablecoins could become the new infrastructure and early movers may enjoy a durable advantage.

Implementation Considerations: Custody, Infrastructure, and Compliance

Adding stablecoins to a bank’s infrastructure requires more than new software. It demands secure custody systems, robust compliance processes, and technical integrations with blockchain networks. Below are key areas to consider:

Custody and Wallet Infrastructure:

Stablecoins are bearer assets, which means whoever controls the private key controls the funds. Banks must choose between two models:

Custodial wallets: The bank holds the keys and manages transactions on behalf of the customer.

Non-custodial wallets: Customers hold their own keys, and the bank provides tools for access or monitoring.

A private key is like a password that grants access to your digital money. If lost access to the funds are likely gone.

Most banks will start with the custodial model. It offers more control, and most customers are not ready to manage private keys. Banks will need secure infrastructure such as hardware security modules (HSMs), secure enclaves, and permissioned access systems to protect wallets.

To avoid building from scratch, banks can work with vendors like Privy, which offer secure wallet infrastructure, built-in onboarding flows (email or social login), and compliance tooling. These integrations allow the bank to focus on UX while knowing the backend is protected.

Blockchain Network Integration:

Banks must decide which stablecoins and chains to support. USDC and USDT are common starting points. They operate on networks like Ethereum, Solana, and Tron. Once selected, banks need a backend that can send and receive transactions on those blockchains, likely through partners such as Fireblocks or Anchorage.

Some banks may partner directly with stablecoin issuers, enabling instant conversion between dollars and tokens. Smaller players like FV Bank have already integrated stablecoins like USDC, USDT, and PYUSD into their systems, showing that bank-grade integration is feasible today.

Stablecoin Mint and Redemption

If a bank wants to issue its own stablecoin, it needs systems for minting and redeeming. Minting should only happen when dollars are deposited, and tokens should be burned when redeemed. This requires a smart contract system tightly connected to the bank’s fiat ledger.

Even if the bank doesn’t issue its own coin, it still must handle customer deposits and redemptions involving third-party stablecoins. Think of it like digital ATM logistics. FV Bank, for instance, automatically mints PYUSD for outbound transfers and redeems on inbound.

Mint/Burn: When a customer deposits $1, the bank creates (or “mints”) 1 stablecoin(s). When they withdraw, the stablecoins are destroyed (“burned”) and the $1 is returned. One stablecoin in circulation always equals one real dollar held in reserve.

Compliance and Analytics

Banks must apply full KYC/AML controls to stablecoin transactions, just as they do for regular money movement. This includes:

Knowing who owns each wallet (KYC)

Monitoring for fraud or suspicious activity (AML)

Checking for sanctions exposure

Blockchain addresses are pseudonymous, so most banks will initially limit transfers to whitelisted or known wallets. They’ll also need analytics tools like Chainalysis or Elliptic to monitor flows and flag illicit behavior.

The Travel Rule adds another layer. For transfers above a threshold, banks must transmit sender and receiver identity. However, new protocols are emerging to securely attach this metadata to on-chain transactions.

Risk Management and Controls

Blockchain introduces new failure modes. Banks must:

Use strong access controls for private keys

Implement multi-signature approval for large transfers

Prepare for downtime or congestion on blockchain networks

Audit smart contracts if deploying any proprietary code

Monitor cybersecurity threats to APIs and wallet systems

Any breach can lead to immediate loss of assets, so regulators will most likely expect banks to meet traditional standards of oversight in the crypto domain.

Partner vs. Build

Banks don’t need to go it alone. Most will find it faster and safer to work with trusted vendors for custody, compliance, and integration. Examples include Fireblocks (wallets), Anchorage (custody), TRM Labs (compliance), and Circle (issuance). A phased approach starting with third-party stablecoins, then potentially issuing their own would allow banks to scale their efforts without overextending.

Privacy, Security, and Trust: The Role of ZK Proofs and Privacy Tech

Public blockchains offer transparency, but that feature comes with tradeoffs. Every transaction is visible, even if addresses are pseudonymous. This makes it possible for others to infer sensitive financial activity, which poses a problem for both individuals and institutions. Retail users may not want their spending habits public. Banks certainly do not want their internal flows or client data exposed.

Fortunately, advances in cryptography are helping resolve this tension. Tools like zero-knowledge proofs (ZKPs) allow users to prove something is true without revealing the underlying data. This offers a potential bridge between blockchain’s openness and the confidentiality banks require.

How ZK Proofs Work

ZKPs can verify facts about a transaction or account without revealing details. For example, a user can prove they passed KYC and are not sending money to a blacklisted address, without revealing their name or full transaction history.

This can be used in practice. A bank could process stablecoin transfers that include cryptographic proofs, showing regulatory conditions are met. The receiving institution or regulator could verify the proof, but the sender’s identity remains private unless disclosure is legally required. A Stanford led research paper argues this model satisfies both privacy and compliance requirements, especially when implemented correctly.

Why Banks Need Privacy Layers

Full visibility is not always a feature. In banking, it can be a liability. Confidentiality protects trading strategies, client relationships, and internal operations. Institutions cannot afford to expose this data on public ledgers. There are several practical ways banks can implement privacy-preserving stablecoin systems:

Custom blockchains or permissioned ledgers: These allow banks to restrict access to transaction data while still using blockchain architecture.

Public chains with ZK-enabled protocols: Banks can join shielded pools where transaction metadata is private, but still provable. Only authorized entities, such as regulators, can view the full transaction if needed.

Identity-proof systems: Projects like Concordium are exploring ways to attach identity credentials to blockchain accounts without making them public. A user’s identity is verified, but not exposed during each transaction.

User Data and Privacy Tools

In addition to transaction privacy, banks must protect personal data. Tools like Privy enable off-chain storage of sensitive information while linking it to blockchain accounts through encrypted identifiers. This gives the bank the ability to comply with subpoenas or legal requests without exposing the data by default. From the user’s perspective, they remain pseudonymous on-chain unless an event triggers disclosure.

The goal is not secrecy. It is selective visibility. The right parties should be able to access relevant data, but that does not mean everyone should see every transaction. Privacy-preserving design enables regulatory compliance without undermining user trust or security.

“The future lies in systems that allow people to transact securely and privately, while still proving they meet legal requirements.” - As Howard Wu (Aleo)

U.S. Regulatory Landscape and the GENIUS Act

Stablecoins are finally leaving the regulatory gray zone. U.S. lawmakers are acknowledging their growing importance in payments and digital finance. At the center of this shift is the Guiding and Establishing National Innovation for U.S. Stablecoins Act of 2025, or the GENIUS Act. This bill provides the first federal framework for how stablecoins should be issued, managed, and integrated into banking.

Key Provisions of the GENIUS Act

Federal Licensing and Oversight: Stablecoin issuers can now apply for a federal license. Fully backed and redeemable stablecoins will not be regulated as securities or commodities. This removes the ambiguity that previously slowed adoption.

Reserves and Redemption Rights: Issuers must hold 100 percent reserves in liquid assets. These include cash, Treasury bills, and other low-risk instruments. Customers are guaranteed the right to redeem stablecoins at par, and they receive priority in bankruptcy scenarios.

Transparency and Disclosure: Issuers must publicly disclose their reserve composition and undergo regular audits. This helps build trust and limits the risk of opaque or overleveraged operations.

Financial Stability Measures: The Act limits the use of leverage and bans reinvesting reserves in risky assets. Liquidity requirements are in place to ensure stablecoin providers can handle mass redemptions during stress events.

AML and Sanctions Compliance: All issuers must implement Know Your Customer (KYC) protocols and comply with anti-money laundering rules. Even foreign issuers must follow U.S. laws if their stablecoins are to circulate in American markets.

Implications for Banks

The GENIUS Act offers clarity, which is exactly what banks needed. With defined rules, banks can confidently enter the stablecoin space and begin building offerings within their existing compliance frameworks.

The Act also levels the playing field. When all issuers must hold the same high-quality reserves, it removes the incentive to cut corners. This benefits banks, which already follow strict regulations. Instead of competing against unregulated actors with looser standards, they will compete on user experience, reliability, and integration.

There are still open questions. Stablecoin balances are not insured by the FDIC like traditional deposits. Banks will need to clarify what protections apply. Some may seek private insurance or new legal designations. Others may offer clear disclosures to differentiate between deposit accounts and stablecoin wallets.

Customer Perception and Competitive Strategy

Even without deposit insurance, banks have an edge. Customers are more likely to trust a stablecoin issued or supported by a bank than one from an offshore platform. The bank’s reputation, oversight, and physical presence provide reassurance, especially for risk-averse users.

Some banks might also share interest from stablecoin reserves, similar to what PayPal does with PYUSD. This would make stablecoin balances more attractive, possibly competing with savings accounts. If the bank earns 5 percent on reserves and pays customers 3.5 percent, it still retains a meaningful spread.

The GENIUS Act also creates space for banks to experiment. With federal oversight in place, banks can develop and test products without fearing sudden legal reversals. That opens the door to innovation, whether through issuing their own stablecoins or integrating third-party ones into daily operations.

Unit Economics and Profitability Considerations

For any new service to succeed in banking, it needs to make financial sense. Stablecoins bring both revenue potential and cost considerations. Banks must weigh these carefully when planning an offering.

Revenue Opportunities

Transaction Fees: Just as banks charge for wire transfers or FX, they could apply small fees to stablecoin payments. Even a $0.10 fee per transaction, when scaled across millions of transfers, adds up. This would still undercut the $30 charged for international wires.

Foreign Exchange and Cross-Border Margins: Stablecoin based remittances give banks a chance to offer better rates while still collecting spreads on conversion. For example, a bank might offer local off-ramps for stablecoin recipients abroad and earn 1% to 2% per transaction, similar to retail FX today.

Custody and Premium Services: For large accounts or business clients, banks could charge for stablecoin custody or offer APIs for mass payouts. While basic custody may stay free for retail customers, business models can mirror those used for treasury or escrow services.

Interest on Reserves: If a bank holds customer stablecoin balances or issues its own token, it will manage a reserve of backing assets like Treasury bills or Fed deposits. These earn interest. Even if the bank shares part of that yield with customers, the remainder is a steady income source. For instance, with short-term Treasuries yielding 5%, a bank could split the interest 50–50 and still profit.

Product Cross-Sell: Offering stablecoins may attract new users, deepen relationships with existing ones, and grow overall balances. These users may eventually apply for credit cards, loans, or investment products. The halo effect of being seen as an innovative bank can boost retention and customer lifetime value.

Cost Factors

Technology Infrastructure: Banks must invest in wallet systems, blockchain connectivity, user interfaces, and secure key management. Licensing third-party vendors like Fireblocks or Privy can reduce time to market but adds recurring costs.

Compliance and Risk Monitoring: Stablecoin activity requires enhanced AML tooling and blockchain analytics. Services like Chainalysis or TRM Labs come with subscription fees. Banks also need to train compliance teams and update policies for digital assets.

Customer Support and Education: Launching stablecoin products means dealing with a new set of questions and user issues. Banks must prepare help centers and train frontline staff. Mistaken transfers or fraud cases could require partial reimbursements, depending on policy.

Opportunity Cost: If customers shift deposits into stablecoin balances, the bank loses access to low-cost funds it would otherwise use for lending. Stablecoin reserves must stay liquid and cannot be lent, which may compress net interest margins.

Example Profitability Model

Imagine a bank with 1 million customers, 10% of whom adopt stablecoins. If each user holds $1,000, the bank controls $100 million in float.

Interest at 5 percent = $5 million per year

If the bank pays 2.5 percent to users, it still earns $2.5 million

Transaction revenue (5 transfers/month per user) = 60 million annual transfers

At $0.10 per transfer = $6 million in transaction revenue

Add $1–2 million in FX or account fees

Total: $9-$10 million in annual revenue from 100,000 users.

Float refers to the total customer funds the bank can hold and earn interest on while in stablecoin form.

If adoption scales to half the customer base, many costs remain fixed, and margins improve. These numbers are not perfect, but they show that stablecoin products can be financially viable.

Of course, all this depends on adoption, execution, and rate conditions. If rates fall or competition squeezes fees, margins will tighten. But even in those cases, the strategic upside remains.

Conclusion

Stablecoins present both a threat and an opportunity for U.S. banks. They challenge old models and introduce new players, but also offer faster payments, new revenue streams, and a modern edge. As this essay laid out, banks that integrate stablecoin infrastructure stand to improve operations, reach new markets, and stay competitive in a shifting financial landscape.

But getting there takes investment. Banks will need secure wallets, strong compliance programs, and perhaps partnerships with crypto-native firms. Privacy tools like ZK proofs can protect customer data while meeting regulatory expectations. Risk management must be as strong as anything in the traditional system. The good news is that tools and examples already exist.

The GENIUS Act is a turning point. It brings regulatory clarity and a framework banks can work within. With rules around reserve backing, disclosures, and compliance locked in, banks can operate without hesitation. As regulated institutions, they’re well-positioned to help shape the next chapter of digital finance.

Crucially, embracing stablecoins doesn’t mean giving up what makes banks trusted. Done properly this should combine crypto’s speed with existing banking grade security.

If you're building in this space or exploring use cases at your institution, feel free to reach out on LinkedIn, Substack, or Email. I’m always up for thoughtful conversations on what comes next.

“2025 might be a ChatGPT moment for blockchain in banking.”

-Citi

Sources:

Axios (B. Dale). “Banks in the stablecoin future.” (Apr. 24, 2025)

Bovill Newgate. “Guardrails for the digital dollar: The GENIUS Act explained.” (May 29, 2025)

ABC News. “What to know about the GENIUS Act...” (May 20, 2025)

Elliptic (L. Shetret). “Five profitable ways banks can engage with stablecoins.” (Apr. 4, 2025)

Coinbase Institutional Research. “Stablecoins and the New Payments Landscape.” (Aug. 2024)

Decrypt (H. Wu). “Why Wall Street Won’t Embrace Crypto Without Zero-Knowledge Privacy.” (May 11, 2025)

Business Wire. “FV Bank Adds PayPal’s PYUSD Stablecoin to..Payment Options.” (Jan. 9, 2025)

CIO Dive (M. Ashare). “Capital One touts efficiency gains from long-haul IT makeover.” (Jan. 22, 2025)

https://medium.com/@dawncapitalteam/stablecoins-the-next-global-payment-rail-61770b55c75c - Published Apr. 10, 2025

https://coin98.net/stablecoin-analysis - Published Apr. 22, 2022 (Updated Oct 11 2023)

https://www.investopedia.com/articles/personal-finance/050515/how-swift-system-works.asp